Co-Authors: Saurabh Bangar and Aneez Devji

The real estate market in British Columbia faces unique challenges. Rising interest rates, economic uncertainty, and shifting purchaser demand have slowed activity in recent years. For developers, financing and constructing large-scale projects is more complex, and reduced demand makes it difficult to meet timelines. For purchasers, it means carefully considering any decision to purchase within a development project.

The Real Estate Development Marketing Act (REDMA) is provincial legislation that applies to certain types of development projects marketed in British Columbia. REDMA ensures purchasers are informed while providing developers with a legislative framework to market development projects, playing a role in presales where purchasers often enter into a purchase agreement before construction is complete, or even before it begins. To support this framework, the British Columbia Financial Services Authority (BCFSA) issues policy statements under REDMA that enable developers to market earlier while helping protect purchasers by ensuring they receive transparent and timely disclosure.

Policy Statements 5 and 6

BCFSA issued Policy Statements 5 and 6 under REDMA, permitting developers to commence marketing projects before completing certain approvals, provided they meet specific conditions. These policy statements are critical in British Columbia’s real estate market, where municipal approvals and financing arrangements can take significant time to finalize. The policies aim to create some flexibility for developers while maintaining protections for purchasers by ensuring that specific timelines are adhered to and that material information is disclosed to them.

Policy Statement 5 permits marketing to commence once an “approval in principle” has been obtained, typically in the form of a development permit or third reading approval from a municipality. A disclosure statement outlining project timelines must be filed, and the developer has 12 months to obtain an issued building permit. If the building permit is issued within the 12 months, an amendment must be filed and distributed to purchasers. If not, marketing must cease until the amendment is filed, and purchasers have the right to cancel their purchase agreements.

Policy Statement 6 addresses construction financing. Developers may begin marketing the project under this policy statement without a confirmed “satisfactory financing commitment”, provided they file an amendment within 12 months confirming that financing has been secured. Suppose financing is not obtained within the 12 months. In that case, marketing must cease, and purchasers again have the option to cancel their purchase agreements until financing is secured and an amendment is filed and distributed to purchasers. Satisfactory financing means the ability to construct the development project, including the installation of all utilities and other services associated with it. Financing can be provided by a lender, through the developer’s own funds, or a combination of the two.

Early Marketing Pilot Program

On February 25, 2025, the BCFSA introduced an Early Marketing Pilot Program, extending the early marketing period from 12 months to 18 months for eligible projects. Residential developments with 100 or more units qualify, and developers receive an additional six months (for a total of 18 months) to secure building permits or financing before purchasers may cancel their purchase agreements. Existing projects already being marketed can also apply for the extension by filing an exemption and updating their disclosure statements.

The pilot reflects an effort to balance prolonged municipal approval timelines, more stringent lending conditions, and reduced demand, against the need to protect purchasers’ consumer rights. Through this program, the BCFSA will collect data to evaluate how extended early marketing periods affect financing viability and purchaser confidence.

Looking Ahead

With financing conditions challenging and presale demand uncertain, understanding REDMA and BCFSA policies is essential. For developers, these frameworks provide opportunities to market a development project early, provided the required timelines are met. For purchasers, they offer transparency and certain key protections to provide some level of confidence when entering into purchase agreements.

Disclaimer: The foregoing does not constitute legal advice and should not be relied upon as such; for legal advice, please contact the co-authors.

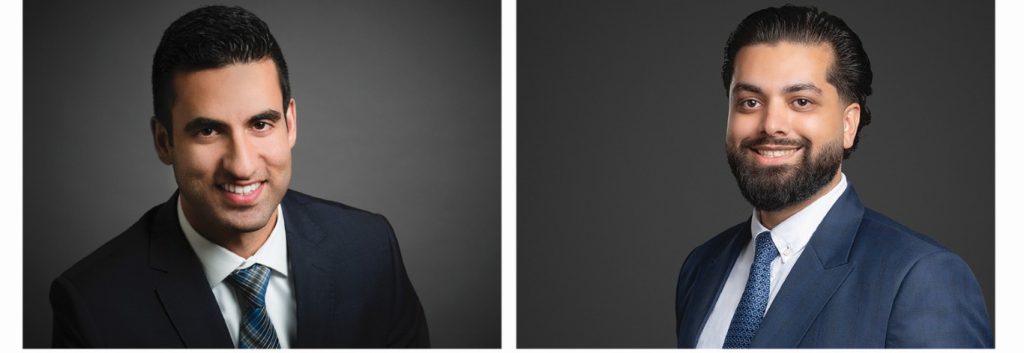

Co-Authors: Aneez Devji and Saurabh Bangar

This article is co-authored by Saurabh Bangar and Aneez Devji, commercial real estate lawyers at Richards Buell Sutton LLP (RBS). Established in 1871, RBS is the oldest law firm in British Columbia with offices in Surrey and Vancouver. Aneez serves as the Managing Partner, and Saurabh is an Associate. Both are members of the firm’s South Asian Practice Group and advise on a wide range of real estate matters, including development, marketing, commercial leasing, acquisitions and sales, land assemblies, and more.