The Punjabi actor died near the Singhu border, the centre of last year’s farmer protests. Sidhu was on the way to Punjab from Delhi, sources said.

Sidhu was travelling with his friend Reena. The accident occurred on Kundli-Manesar-Palwal Expressway near Pipli toll plaza. The accident spot was nearly 30 km from the Singhu border, the centre of last year’s farmer protests. He was gravely wounded and died on the way to the hospital.

Deep Sidhu (37) was cremated at Threeke village in Ludhiana on Wednesday. His body was kept at his younger brother advocate Mandeep Singh’s house in the village where people in large numbers especially youth reached to pay tributes.

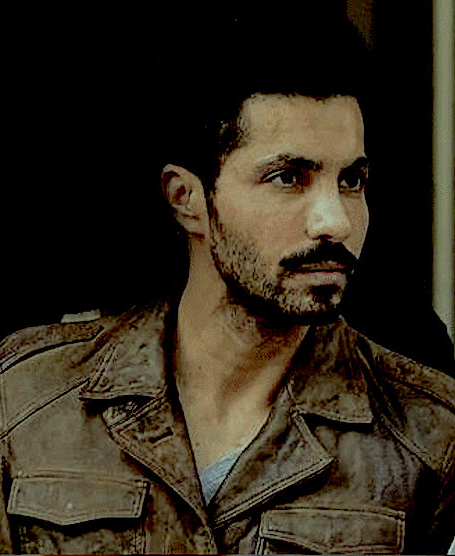

Deep Sidhu (2 April 1984 – 15 February 2022) was an Indian barrister, actor, and activist who worked in Punjabi language films. Sidhu started his film career with the Punjabi film Ramta Jogi which was produced by actor Dharmendra under his banner Vijayta Films.