In light of International Women’s Day on March 8, Better Business Bureau (BBB) serving Mainland BC is highlighting the need for scam reporting and celebrating the women who share their stories with BBB Scam Tracker.

According to the 2022 BBB Scam Tracker Risk Report, more Canadian women (63.5%) reported scams to BBB Scam Tracker than men (36.5%). The percentage of women who reported losing money after being targeted by a scam (susceptibility) increased to 47.8% in 2022, from 44.4% in 2021, while susceptibility for men dropped to 46.7% in 2022, from 48.5% in 2021.

Overall men and women are about equally as susceptible to scams, yet, women are reporting scams more often, possibly indicating they also encounter scams more often. When falling victim to a scam though, the median dollar loss for women was markedly lower than men at $249, versus $453, show that although reporting less often, men are losing more money.

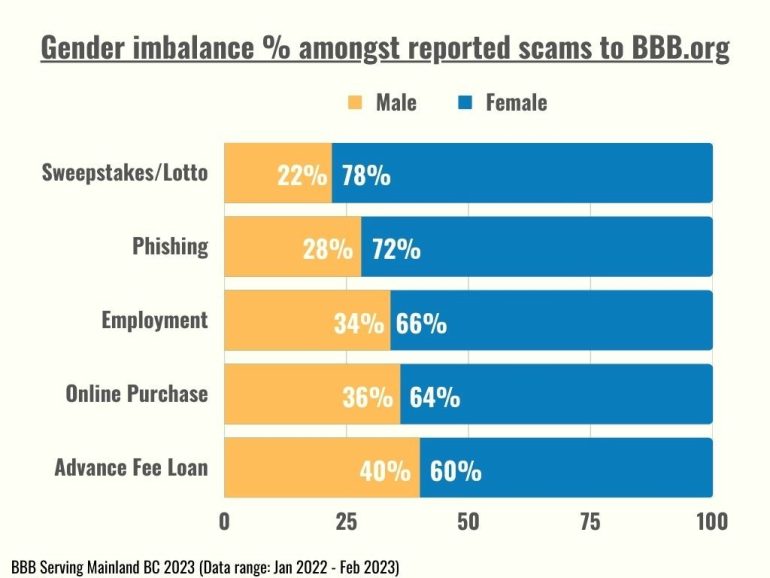

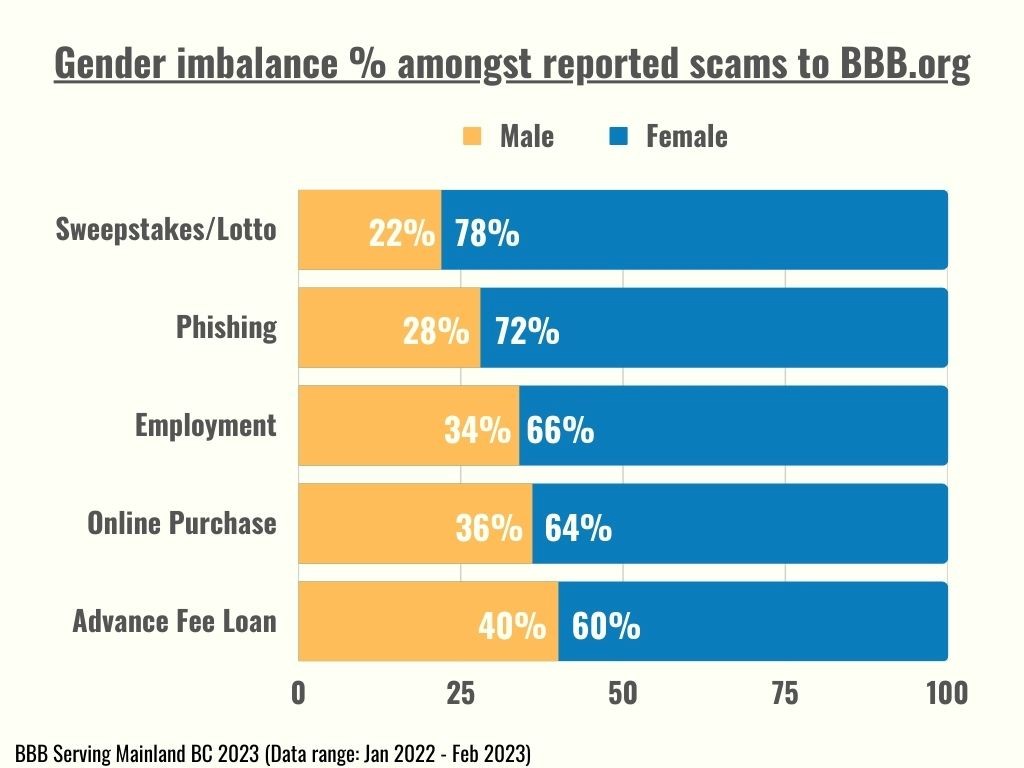

Looking at data from January 2022 – February 2023 across Canada, women reported the following 5 scams the most often: sweepstake/lottery scams, phishing scams, employment scams, online purchase scams, and advance fees.

Men, however, only reported 20-40% of these instances. Notably, four out of the five of the aforementioned scams are a part of the newly released BBB Top 10 Riskiest Scams of 2022 – advance fee loans at #3, employment at #5, online purchase at #6, and phishing at #10.

As outlined in the graphs above, women are reporting instances of scams more often than men. Date range January 2022 – February 2023. Source: BBB Mainland BC & Yukon Territory

“More Canadian women reported scams to BBB Scam Tracker than Canadian men in 2022. This is important to note, because by sharing their stories, these women are protecting future consumers from falling prey to similar scams,” shared Aaron Guillen, Media and Communications Specialist at BBB of Mainland BC. “The Canadian Anti-Fraud Centre estimates that Canadians report only 5-10% of actual fraud cases, meaning that the actual impact of fraud is much larger than we know.”

The Better Business Bureau encourages those who have fallen victim to a scam or been able to detect and avoid a potential scam to share their stories. There is power in sharing your scam experiences, as your story will help warn other consumers and businesses on what to watch for and how to protect themselves. To report a scam, head over to BBB Scam Tracker, call your local police, and contact the Canadian Anti-Fraud Centre at 1-888-495-8501.

For those who want to increase their cyber smarts, we encourage you to sign up for the Discover Online Safety Webinar on March 21 at 11am PST, presented by Media Smarts, in partnership with the BBB.

How to avoid the top five scams that women report falling victim to more than men:

Facing a sweepstake/lottery scam? Remember that you’ve got to play to win. A notification that you have won a prize in a contest you do not remember entering should be a red flag. If you do regularly enter contests or sweepstakes, make sure you keep track of your entries so you can easily check to see if you have actually entered the contest referenced. If they want money for taxes/fees, themselves, or a third party, it most likely is a scam.

Facing a phishing scam? Do not click on any unfamiliar links or attachments. Any unsolicited or unexpected communications asking for personal information or asking you to take immediate action should be a red flag. Many of these messages are from impostors pretending to be trustworthy businesses and organizations. They are “phishing” for Social Insurance Numbers, banking information, passwords, credit card information, or other personal details for use in identity theft. Don’t fall for the bait!

Facing an employment scam? Never make any upfront payments for a job. Beware of businesses that ask applicants to pay for job supplies, applications, or training fees. Be careful if a company promises you great opportunities or a big income under the condition that you pay for coaching, training, certifications, or directories. These expenses are the employer’s responsibility – and asking for money is a big red flag that something is wrong.

Facing an online purchase scam? If the deal looks too good to be true, it probably is. Price was the top motivating factor for people who made a purchase and then lost money. Don’t shop on price alone. Avoid paying by wire transfer, prepaid money card, gift card, or other non-traditional payment methods. Pay by credit card, as they often provide more protection against fraud and unauthorized transactions.

Facing an advance fee loan scam? Avoid guarantees. Real lenders never guarantee a loan in advance. They will check your credit score and other documents before providing an interest rate and/or loan amount and will not ask you to pay an upfront fee. There are often fees charged for loans: application fees, appraisals, and credit report fees. A real lender will post those fees prominently and collect them from the money they are lending you, but a scam lender may try to collect them as a condition for you to get money.

BBB celebrates the women-led businesses that power our communities throughout the region, including BBB’s own CEO and President Simone Lis, not only on International Women’s Day, but every day.