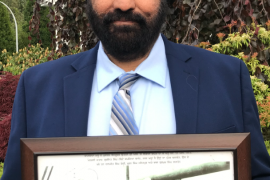

The Tim Horton’s annual Smile Cookie Campaign raised over $163,000 for the BC Children’s Hospital Foundation this year. The Smile Cookie campaign runs once a year, this year between September 16-22, 2020. Cookies are sold at $1 a piece and together the campaign raised a record-breaking $10.56 million dollars for charities Canada-wide. Pictured is local Tim Hortons Owners Ajit and Harj Thandi along with Ben Yip (Tim Hortons Marketing) presenting the cheque to the BC Children’s Hospital Foundation representative on behalf of all BC owners at their 49th and Main Street Tim Hortons in Vancouver”.