HealthLinc Medical Equipment Ltd. (HME®) one of the largest independent dealers of Mobility and Home Medical Equipment in the Lower Mainland and Vancouver Island

HealthLinc Medical Equipment Ltd. (HME®) began as a local medical equipment rental company, and during the past 23 years has grown to become one of the largest independent dealers of Mobility and Home Medical Equipment in the lower mainland and Vancouver Island. With over 60 staff operating out of over 25,000 s.f. in Richmond, South Surrey and Victoria, we are fully active in Rehab Sales and Consultations, Pediatric Sales and Consultations, operate HME Accessibility (hmestairlifts.com) manage the ALSBC inventory loan program, and manage multiple Palliative, Home First and other equipment rental programs in both Vancouver Coastal and Fraser Health Authority regions. We are proud to announce effective Dec. 1,2017 HME is the new equipment loan manager for the Children’s Medical Equipment Distribution Service (CMEDS) program. The HME CMEDS program is a pediatric equipment recycling pool that is funded by the Ministry of Children’s and Families (“MCFD”).

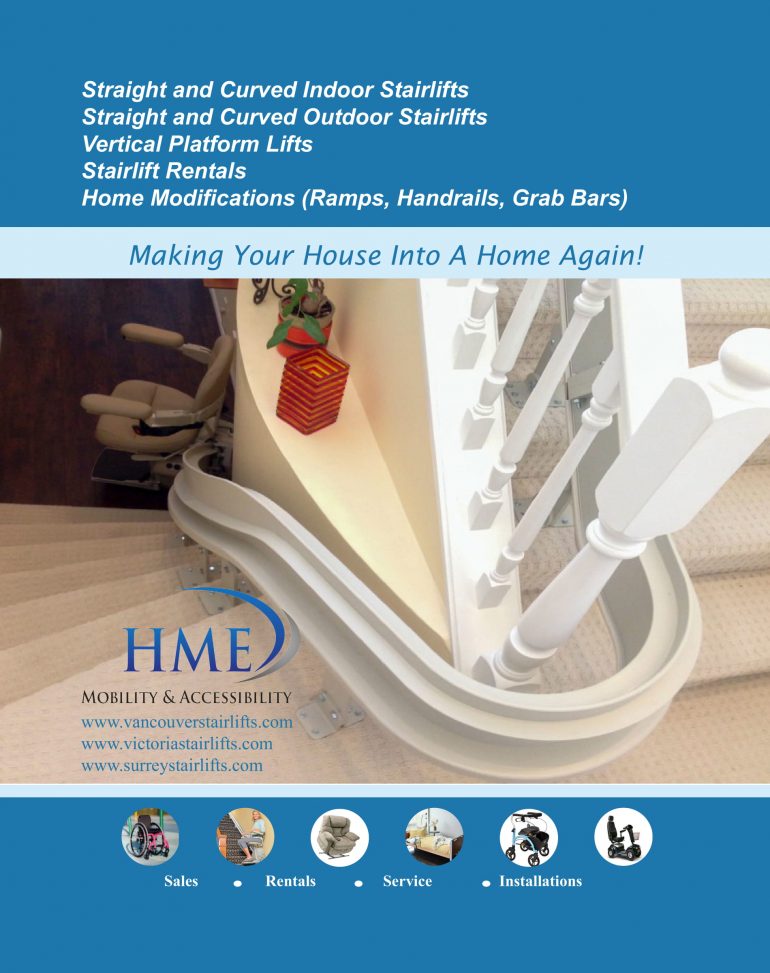

HME’s team has trained caring professionals with extensive product knowledge and a sincere desire to deliver the comfort items you need. We deliver, set up and install all of the items we sell. In addition, our Customer Service and Product Specialists aid in finding the solutions to our clients’ needs, while offering caring, knowledgeable support. Our Mobility Consultants specialize in power & manual wheelchairs, seating & mattress requirements, stairlifts, porch lifts, walkers-rollators & ambulatory devices, bathroom safety, beds.

HME is owned and operated by local owners, actively involved in the business. The head of our Accessibility division is the President of the Home Medical Equipment Dealer Association of BC (www.hmeda.com). As the leader of the association, HME is a proud market leader on ensuring the quality of our service and reputation.

HME is proud member of HMEDA and the Richmond Chamber of Commerce, winner of their 2013 Business Excellence Award.