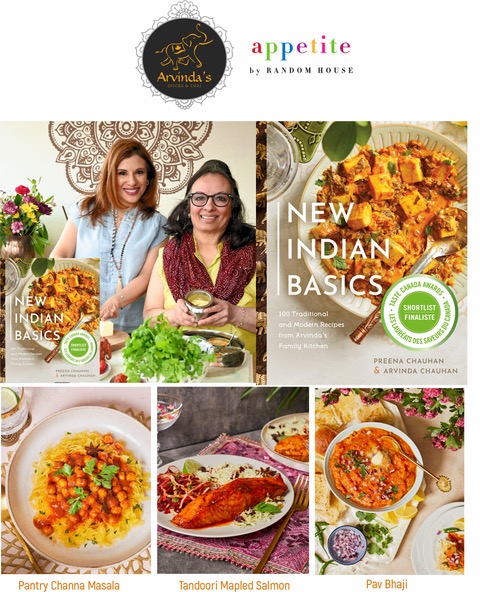

OAKVILLE, Ontario, June 19, 2023: Announced this month, New Indian Basics: 100 Traditional and Modern Recipes from Arvinda’s Family Kitchen (2022, Appetite by Random House) was shortlisted in the 2023 Taste Canada Awards.

In New Indian Basics, Preena Chauhan and Arvinda Chauhan—the masters behind Arvinda’s Indian spice blends—present a collection of flavourful, accessible recipes and kitchen wisdom gained from a lifetime of personal and professional experience teaching Indian cooking, where spices take center stage. With their clear instructions and signature warmth, the mother-daughter duo guide readers to flawless renditions of Indian dishes, both traditional and modern, with absolute ease.

In this cookbook, Preena and Arvinda share stories and anecdotes revealing how their Indian culture is deeply intertwined with their proud Canadian identity. Preena states, “The recipes in New Indian Basics are very much classical Indian, focusing on the technique of cooking with spices in a very accessible way. The taste of tradition is coupled with modern recipes that use Indian flavours with local and seasonal Canadian ingredients.” Recipe highlights include a Canada Day favourite, Mapled Tandoori Salmon, an autumn Pantry Channa Masala served on a bed of garlicky spaghetti squash and Pav Bhaji, a Mumbai specialty that is flexible using local, seasonal vegetables, and delicious for summer patio entertaining.

Arvinda Chauhan states, “I proudly support local farmers and love the bounty of quality vegetables our growing season has to offer. I also grow vegetables in my garden, everything from fresh cilantro to kale, to peppers and bitter gourds. I creatively add

spices to what is local and seasonal.” As an artist, Arvinda analogizes cooking with spices to painting a picture. The spices act as the paint on a painter’s palette—a diversity of flavours are at your fingertips to create a masterpiece in your kitchen. “Ever since I

came to Canada in the 70s, the beauty and geography of the Canadian landscape and changing seasons inspires me to cook.”

The winners will be announced during the Taste Canada Awards Soirée on October 30, 2023 in Toronto.

New Indian Basics cookbook—shortlisted in the 2023 Taste Canada Awards—celebrates Indian culinary tradition with local ingredients this Canada Day and for summer entertaining

Mother-daughter co-authors share their impeccable Indian recipes with their timeless spice flavouring tips from three decades of teaching Indian cooking classes in their debut cookbook, which celebrates their Indian culinary tradition and life in Canada.